Ten years ago this autumn, I got my first personal cell phone. Today, I got my sixth.

Ah, the halcyon days of the late 1990s. It’s somewhat fitting that my first phone was a Motorola MR30, a big candybar contraption with a monochrome screen and no camera. It made calls, but it didn’t do much else. I had service through Aeriel, a long-gone company riding the wave of the digital PCS revolution.

Those were the days when cell phones were still novelties. I was one of only a handful of people in my high school circle of friends to have a cell phone. I was also one of the only people in the entire school to have a Palm Pilot (the good ol’ Professional model).

As it happened, my mom decided to get a cell phone a few months after me. She was supposed to get one of the ubiquitious Nokia 5190 phones, but for unclear reasons, the store gave her a far-superior Nokia 6190 instead. That phone was much better than my own — it had Snake on it! An agreeable mother and a SIM card swap later, it was mine! Loved it.

Jump ahead two years to the summer of 2001. Aeriel had been purchased by Voicestream, which itself was to be acquired by T-Mobile. The GSM service was spotty down at Rose-Hulman, so I needed a switch. Enter Verizon and the Motorola StarTAC.

I couldn’t believe how small that phone was. Moreover, I was amazed by what it could do: I could surf the web (sort of) with the WAP browser. Amazing! That was particularly useful a few months later when I, like the rest of the country, was desperately hungry for news in the wake of the September 11th attacks. I distinctly remember walking around the Rose-Hulman campus under an unusually clear blue sky, hunting through the mobile Yahoo News site for the latest updates.

That StarTAC served me well. Sure, the antenna broke a few times, but it was solid overall. Not even a trip through the washing machine could do it in.

Still, three years of service was about enough, and it was time for an upgrade, so in the spring of 2004 I switched to an LG clamshell phone. I don’t recall what model it was, but I do know that my little brother Wojo had the same model of phone, which I pranked at some point.

About that time, phones with color screens began coming on the market, so when my LG phone broke — at the worst possible time, when I was trying to make calls on the side of the road to deal with an automotive problem — I decided to get my first color phone. It was a Kyocera KX2, and it was the fall of 2005.

Coincidentally, my little brother Tyler happened to have the same phone. Maybe it was the appeal of the rotating-face design. Maybe it was the superior audio quality. I’m not sure. What I do know is that phone served me well. Sure, the camera was garbage, and the web “browser” was slow, limited, and prone to crashing, but the phone did its job. I liked it enough that I replaced the battery — twice — without replacing the phone.

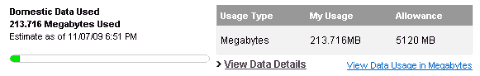

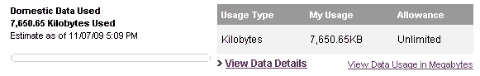

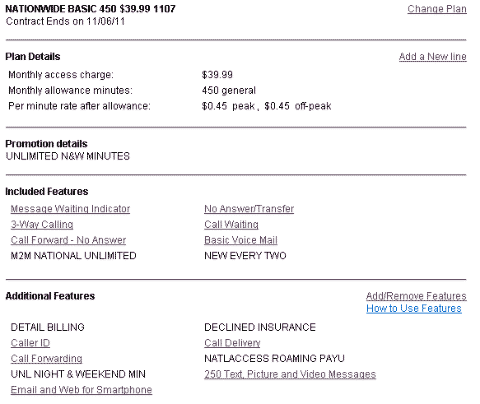

Four long years later, it’s the present, and today I returned to my roots: Motorola. Specifically, the Droid.

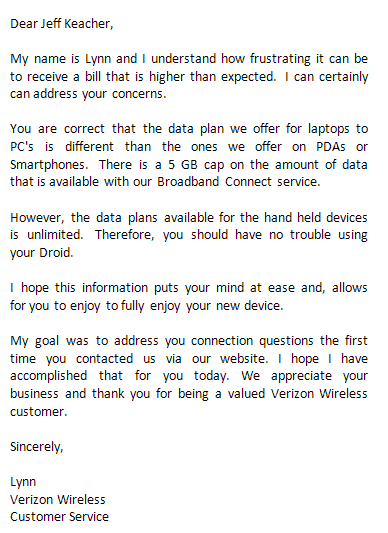

What an upgrade. I love it. I had been resisting the siren song of the iPhone; though I loved the phone, I had no desire to swtich to AT&T. With the Droid, it’s the best of both worlds: a great handset and a wonderful network.

There are lots of comprehensive Droid reviews out there, so I’ll make my take short: It’s great.

I wonder how it will be upstaged by phone #7?

Recent Comments